Work with secure payment data

Being PCI DSS-compliant means that you meet all applicable requirements of the current Payment Card Industry Data Security Standard (PCI DSS) on a continuous basis. PCI DSS was created by major card networks to increase safety of cardholder data and reduce the risk of fraud. All organizations that deal with payment card processing must be PCI-compliant, which means fulfilling very strict requirements on securing cardholder data.

Merchants who find it difficult or expensive to fully comply with PCI DSS requirements may consider using encrypted methods or outsourcing card processing to a PCI-compliant payment service provider. This way their PCI DSS-compliance scope can be significantly reduced.

Collect Cards

Tokenize

Secure Fields (iFrame)

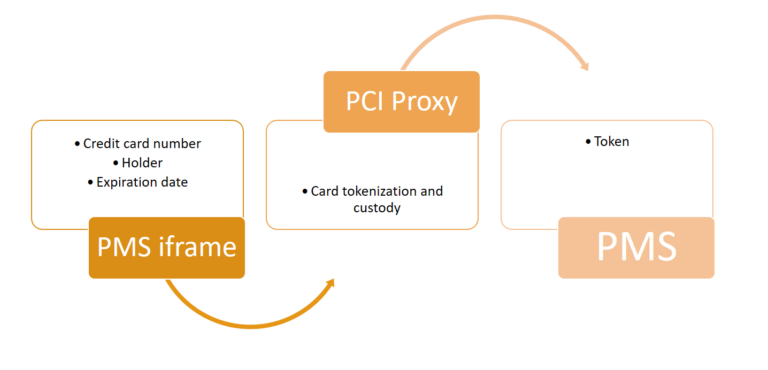

PCI Proxy’s Secure Fields are rich, prebuilt iframes that allow you to create your own seamless checkout experience across all devices without worrying about PCI compliance. Secure Fields shield sensitive information from your site and tokenize payment data on the fly while still giving you full visual control over your payment forms.

The implementation of the new iframe will be triggered from all points in the PMS that allows a card to be inserted.

This iframe will request the card number, the cardholder and the expiration date. It will not be necessary to inform the type of card as before, since PCI Proxy is capable of validating the algorithms of each type of card.

PCI Proxy will check if the card meets a correct format. Once all the data is correct, the request will be sent to PCI Proxy and it will return the corresponding token.

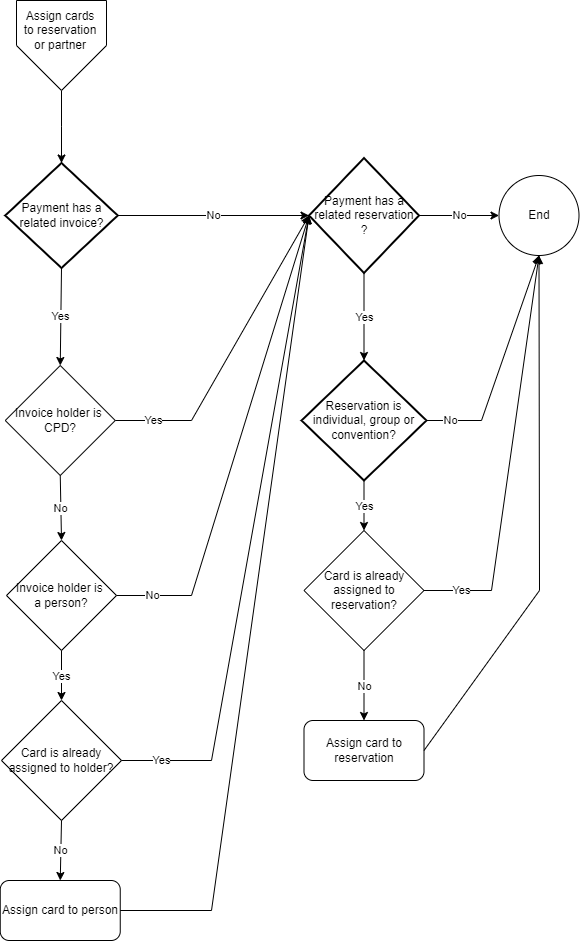

Assign cards to reservations or partners after payment

Filter Proxy

Filter Proxy will be used to tokenize payment data on any in-coming HTTPS traffic. PCI Proxy sits between the client’s API and your server, tokenizing any sensitive data on the fly. Designed as a natural reverse proxy with tokenization

Authenticate

3D Secure

3D Secure is an authentication protocol that provides an additional layer of verification for card-not-present (CNP) transactions. The industry recommends that you use 3D Secure to comply with authentication regulations for online payments such as PSD2 SCA, and to make use of the liability shift.

3D Secure has two available versions:

- 3D Secure 1: Shoppers are redirected to the card issuer’s site to provide additional authentication data, for example a password or an SMS verification code. The redirection might lead to lower conversion rates due to technical errors during

Work with secure payment data Read More »